So you’re finally ready to buy your first home! Whether it’s with your significant other or alone, it’s definitely an exciting and daunting time all in one. It can leave you feeling terrified and doubting whether you’re even making the right decision. So without further ado, here is the ultimate ‘buying your first home’ checklist for dummies – make sure to go through each one to make sure you’ve considered all angles and are totally ready for this big decision!

Is buying even for you?

There are a few factors that could point you in the direction of understanding that buying just may not be for you. Some examples of these could be; if rent is cheap in the area you’re interested in buying and buying is expensive – this could mean your return on investment may not be has high as you’d want. Other reasons could include; not feeling secure with your job, not knowing your concrete plans for the next few years (whether you’d like to move etc.) If any of these are the case, then consider renting until you’re in a more stable position.

Take advantage of all resources.

One thing that first home buyers have to take advantage of, is the First Home Buyers grant. Luckily this is a great time to buy a house as it’s been raised quite significantly this year (from $7000 to $1000.) Those few extra thousand dollars can make a big difference when securing your first home. Companies like Homestart and others are making young couples dreams come true. Click here for information about home owners grants at Homestart

Be reasonable with the costs

If you’re buying a home that is out of your budget, you’ll find yourself spending most of your salary on the mortgage payments each month. This could cause a lot of stress and anxiety until it’s paid off (which could take many years!) And what if other unexpected expenses pop up in the interim? Instead, choose a home within your budget – after all, this is only your first home – it’s not supposed to be absolutely perfect and everything you’ve ever dreamed of. That type of house can come later down the line!

Make sure to invest in inspections

Before buying a home, you must make sure that you don’t cut any corners on inspections. Some things are worth the investment! There have been too many horror stories of young couples purchasing their first homes and then finding out about significant problems within their home that ended up costing them tens of thousands of dollars.

Be smart about where and what you buy

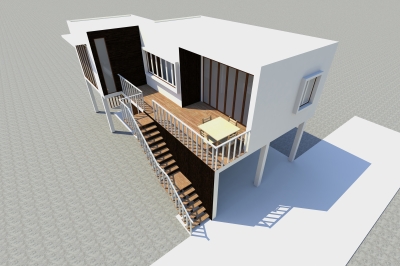

My father always told me “always buy the worst home in the best street.” This is something that runs true today, and will continue running true for years to come! The area in which you buy your home will have the biggest impact on how much profit you make in years to come when you decide to sell. Don’t be put off if the home isn’t stunning – you can always renovate down the line!

Thanks to freedigitalphotos.net for the images!

All The Frugal Ladies Personal finance with a feminine touch

All The Frugal Ladies Personal finance with a feminine touch